Audit procedures on the financial statements have been completed; the auditors report will be issued after verification of all legal documents.

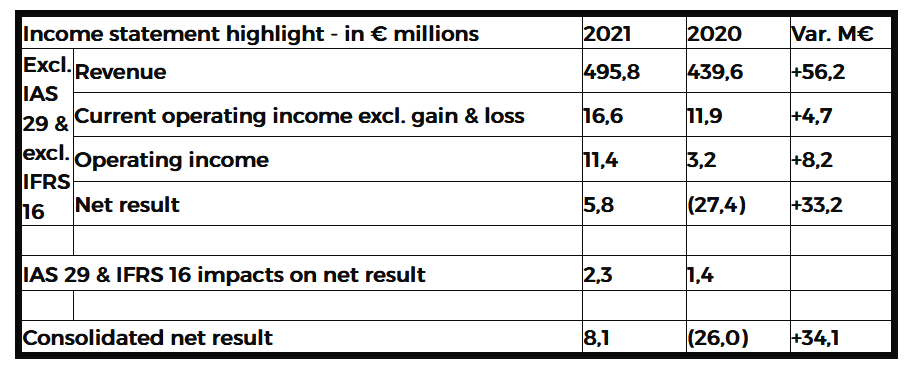

The changes and figures presented below are excluding IAS 29 (hyperinflation in Argentina) and IFRS 16 (leases)

In a global aerial work platform market that is recovering strongly in all geographical areas, Haulotte recorded cumulative sales of € 495.8 million in 2021, compared with € 439.6 million in 2020, an increase of +13% (at constant exchange rates) between the two periods, driven by all its activities.

For the year 2021, the Group posted a current operating income of € +16.6 million (excluding exchange gains and losses), i.e. +3.3% of 2021 sales, up +39% compared to 2020. The increasing difficulties in sourcing components and the significant increase in their prices observed in the second half of the year, weighed on the group's results, despite the excellent sales momentum and good control of fixed costs observed during the year.

In the end, the more favorable exchange rate environment for the Group compared to 2020, particularly for USD, enabled Haulotte to record a net result of € +5.8 million, an increase of € +33.2m compared to 2020.

In this context of strong business recovery, Haulotte saw its net debt (excluding guarantees) increase by € +7.9 million to € 140.9 million, driven by a higher level of investment, in particular due to the construction of its new Chinese factory, with working capital requirements remaining stable over the period.

On December 22nd, 2021, in order to allow Haulotte to maintain the necessary flexibility to manage its business at a time of strong recovery, Haulotte submitted to all the lenders of the Syndicated Loan a request for a waiver concerning the non-compliance with its banking ratios for the periods of December 2021 and June 2022. It was unanimously accepted on February 15, 2022.

As a reminder, Haulotte had obtained on June 30th, 2021, an extension of one more year of the syndicated loan agreement, bringing its maturity to July 17, 2026.

2022 Outlook:

The excellent sales momentum observed over the last few months, which is reflected in a historic level of its order book, should enable Haulotte to post sales growth of more than +20% for 2022 despite the persistence of strong tensions concerning the supply of certain components. Penalized by the strong increase in component prices and logistics costs, the current operating margin (excluding foreign exchange gains and losses) should remain close to the level observed in 2021. Given the information available to date, the conflict in Ukraine should not impact the Group's forecasts for 2022.

Dividend:

A dividend of € 0.22 per share – relating to fiscal year 2021 - will be proposed at the Annual General Meeting on 24th May.

Upcoming events:

First Quarter Sales: April 19, 2022

General Meeting: May 24, 2022